Month Recap

Spring is starting to spring, and the markets could not be crazier! For a touch of personal commentary, I’ve been keeping some extra cash on the sidelines lately. I’m not seeing a ton of value outside of the micro- and small-cap spaces. I’ve dropped some cash into a few new companies in that sphere, but I’ll get into that a little more in the portfolio update section.

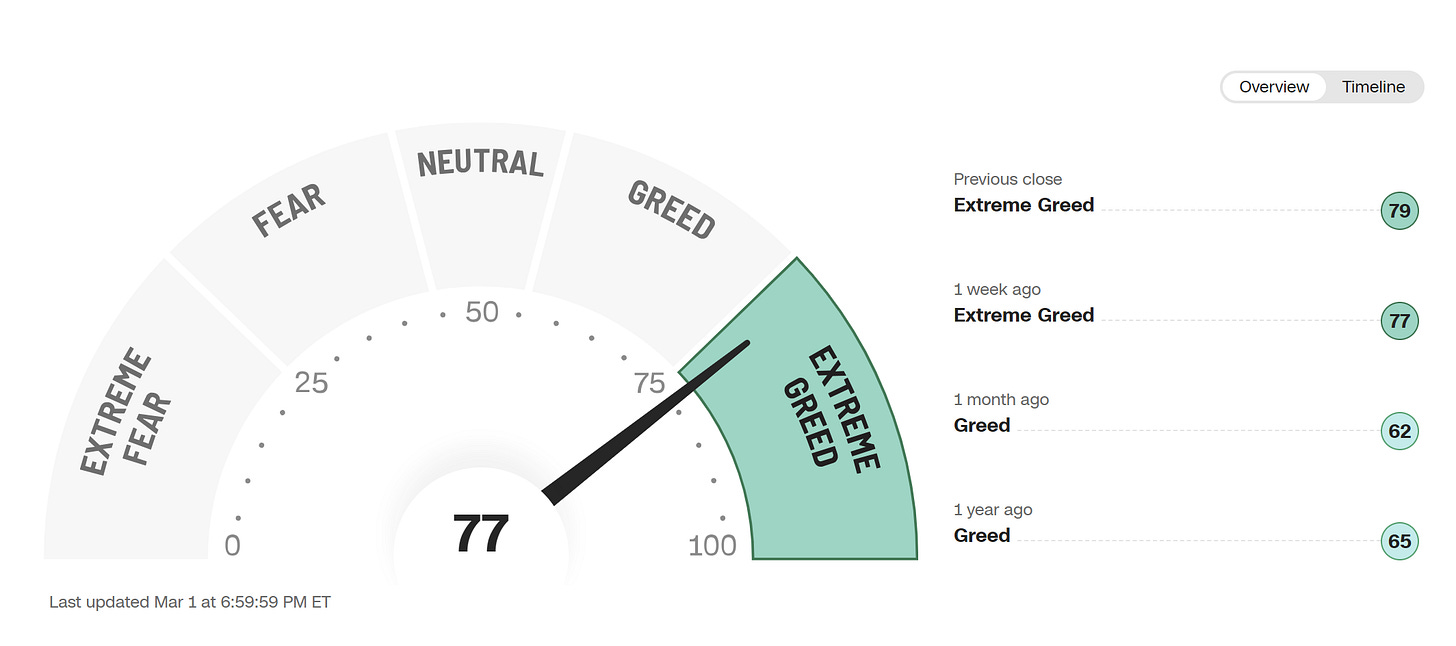

The primary reason I’m keeping cash on the sidelines is that I’m getting extreme 2021 flashbacks over the last bit. The true indicator was a crypto bro telling me I clearly didn’t know how to invest since I was in ASML 0.00%↑ instead of whatever shit token he was hawking. It was very reminiscent of the sort of conversations I was having with people over 2021.

Of course, this isn’t the only factor - good hard math is going into the valuations I’m running on different businesses. But this one interaction was a bit of an eye opener, and got me thinking about how greedy the market is feeling at the moment.

Enough commentary though - let’s get into a recap on the month!

What Happened in the Markets

S&P 500: +5.2% (Best February in 9 years!)

Nasdaq: +6.1%

Dow Jones Industrial Average: +2.1%

Bitcoin: +44.1%

Russell 2000: +5.33%

MSCI EAFE: +2.41%

Fear & Greed Index:

Big News

Apple calls it quits on attempts to enter the EV market after more than a decade (and billions of dollars) of its ‘Projects Titan’ division’s attempts to get the product to market. Reportedly, the move was a surprise, with much of the team being shifted towards AI initiatives instead.

The US returns to the moon, this time with the help of a commercial company, Intuitive Machines. Shares in the company are down nearly 24% over the last week after news that the lunar lander had tipped sideways on the Moon’s surface. Despite short-term headwinds, the company stands to benefit over the next half-a-decade as the US pours money into NASA’s Artemis Program, which aims to begin manned lunar exploration missions in competition with China’s similar efforts.

Elon Musk takes aim at the OpenAI and Microsoft partnership, filing a lawsuit against OpenAI for abandoning the company’s original mission of an open-source AI technology for the benefit of humankind. Musk is suing on the basis that that the partnership with Microsoft has shifted OpenAI towards for-profit operations and away from the goals the company stated when he initially invested.

Watchlist Stocks

Aehr Test Systems - AEHR 0.00%↑

Issue XXX

Aehr is integrating itself into production an quality control processes across mobile and automobile industries, and for other companies using carbide silicon, memory, and logic chips in manufacturing processes. The company is down more than 60% off its highs due to weakened demand in the EV space, but the business is continuing to grow in strong double digits while sporting strong returns on capital and margin growth while servicing growthy markets.

Decisive Dividend - $DE.V

Issue XXIX

Decisive Dividend is following a serial acquisition model in the manufacturing space, targeting companies with growth potential valued at enterprise values <$25m. It began acquiring in 2015 and is beginning to benefit from a larger scale, with 5 acquisitions made over 2023 and an approval for more than a doubling of its debt facilities to further its business model. The company pays a strong dividend with more than a 5% yield, has grown ~74% over the year, and has a long runway for growth ahead of it.

Hammond Manufacturing - $HMM.A

Issue XXVIII

Another microcap with improving business fundamentals, Hammond Manufacturing is in the business of electrical power strips, enclosures, and transformers. This is a nice place to be, with huge tailwinds to the business coming from wider trends towards electrification. Strong double digit top- and bottom-line growth serves as evidence of the trend, while improving margins and capital efficiency metrics are more points in the plus column for Hammond.

Portfolio Changes

It was a pretty quiet month in the markets for me. Beyond starting a few positions, I’ve mostly hung tight with a larger-than-normal cash position that I haven’t been seeing a ton of opportunity to deploy.

Added to position in Payfare at $6.89 per share - February 5th

And again at $7.01 per share - February 13th

Added to Innovative Industrial Properties at $91.34 per share - February 5th

Added to Topicus at $109.70 per share - February 14th

Added to The Trade Desk at $73.00 per share - February 14th

Initiated a position in M-Tron Industries at $38.25 per share - February 14th

Initiated a position in Decisive Dividend at $9.29 per share - February 16th

Sold full position in Teladoc post-earnings at $15.79 per share - February 21

Sold because, even at current market valuations, there are better opportunities to drop cash into, and this company was no longer in line with my original investment thesis. Pretty minimal loss overall, but good to get a crap company out of the portfolio.

Earnings - Hourglass Portfolio

Duolingo - DUOL 0.00%↑

+21% since Q4 and FY Earnings

YoY:

DAUs: 26.9m (+65%)

MAUs: 88.4m (+46%)

Paid Subscribers: 6.6m (+57%)

Paid Subscriber Penetration: 8.3% (up from 7.8%)

FY23:

Revenues: $531m (+44%)

Net Income: $16m (up from -$59.5m)

Free Cash Flows: $144.3m (+212%)

Notes: Not much to say here. Duolingo is a beast. Thesis unchanged, but too richly valued to add any more at the moment.

Schrodinger - SDGR 0.00%↑

-14.5% since Q4 and FY Earnings

FY23:

Total Revenues: $216.7m (+19.7%)

Software Revenue: $159.1m (+17.4%

Net Income: $40.7m (up from -$149.2m)

Software Gross Margin: 81% (+300bps)

Notes: Shares in Schrodinger dropped on weaker guidance through 2024 and a drop in revenues in the drug discovery segment. I think Schrodinger is actually set up for a strong rally in 2024 with the conservative guidance.

Stem - STEM 0.00%↑

-3.73% since Q4 and FY Earnings

FY23:

Revenue: $461.5m (+27%).

Net Income: -$140.4m (-13%).

Non-GAAP gross margins +200bps YoY

Positive Adj. EBITDA for 2H 2023

Notes: There was lots to not love about Stem’s earnings. Significant slowdown in revenue guidance, a pretty large miss on revenue estimates, and weak guidance into 2024 caused the stock to drop significantly. However, Stem reported focus on renewed efficiency in the business, hit targets on cash flow from ops, gross margins, bookings, and CARR, and announced a big customer win for its new PowerBidder Pro platform. Thesis remains intact, but only just - I will be monitoring this one even more closely moving forward.

EQB - $EQB.TO

-10.3% since Q1 Earnings

YoY:

Total Revenue: $299m (+27%)

Adj. Net Income: $108.4m (+17%)

Dil. EPS: $2.76 (+12%)

ROE: 15.6% (-0.3%)

Book Value per Share: 71.33 (+14%)

Total Customers: 426K (+38%)

Notes: Shares took a hit due to continued mayhem in the Canadian housing market, which EQB is exposed to through home loans. Nevertheless, it continues to post fantastic results, with another quarter of fantastic double-digit customer growth supporting my investment thesis.

WSP Global - $WSP.TO

+3.4% since Q4 and FY23 Earnings

FY23:

Net Revenues: $10.9bn (+21.7%)

Acquisition Growth: 12.3%

Organic Growth: 7.3%

Adj. EBITDA: $1.92bn (+25.6%)

Adj. EBITDA Margin: 17.6% (+55bps)

Net Income: $860m (+24.2%)

Net Debt / Adj. EBITDA: 1.5x

Notes: I love this company. Improving margins is great to see, risk from a leveraged balance sheet is minimal with the net debt/adj. EBITDA figure, and organic growth of 7.3% (!) is absolutely fantastic. Nothing changing on my thesis here.

Autodesk - ADSK 0.00%↑

+2.54% since Q4 and FY23 Earnings

FY24:

Revenue: $5.5bn (+10%)

Billings: $5.18bn (-11%)

Subscriptions: 7.53m (+785K)

EPS: $4.19 (+10.84%)

FCF: $1.28bn (-36.9%)

Notes: Same ‘ol, same ‘ol. FCF levels are down significantly, but continued double-digit top and bottom-line growth, along with subscription growth, continues to support industry tailwinds

MercadoLibre - MELI 0.00%↑

-11.3% since Q4 Earnings

Q4 ‘23:

Net Revenue: $4.3bn (+83%)

GMV: $13.5bn (+79%)

Income from Ops: $165m (-31.2%)

TPV: $56.5bn (+83%)

Mercado Pago Credit Portfolio: $3.8bn (+33%)

Total Unique Buyers: 54.4m (+18%)

Notes: MELI got punished a little bit for reduced take rates, but almost every metric performed amazingly throughout the year across all its divisions. Short-term headwind that has no change on my thesis.

The Trade Desk - TTD 0.00%↑

+12.89% since Q4 and FY24 Earnings

FY24:

Revenues: $1.95bn (+23%)

Net Income: $179m (+237.7%)

Adjusted EBTIDA Margin: 40% (-200bps)

Customer Retention Rate: 95%+

Notes: The Trade Desk continues along a fantastic growth path to becoming an industry giant within advertising, with impressive recognition and increased adoption of UID 2.0, plus improving business fundamentals with $647m in share repurchases over 2023 (average price of $63.87).

Topicus - $TOI.TO

+16.7% since Q4 and FY23 Earnings

FY23:

Revenue: 1.125bn (+23%)

Net Income: 115.4m (+32%)

FCF: 123.4m (+126%)

Organic Growth: 7%

Notes: Another fantastic organic growth result, plus huge growth in FCF that should enable future acquisition. Par for the course for Topicus and not outside my expectations, but fantastic anyways.

Arista Networks - ANET 0.00%↑

+2.44% since Q4 and FY23 Earnings

FY23:

Revenue: $5.86bn (+33.8%)

Gross Margin: 61.9% (+80bps)

Net Income: $2.1bn (+54.4%)

Notes: Initial results after earnings punished the stock over weaker guidance in 2024, but has since rallied. The growth this company continues to achieve is spectacular and recognition in deployment furthers my thesis in ANET. Tailwinds from ethernet for AI and the UEC will continue to benefit this company.

TFI International - TFII 0.00%↑

+6.51% since Q4 and FY23 Earnings

FY23:

Total Revenue: $7.5bn (-14.7%)

Net Income: $504.9m (-38.7%)

Free Cash Flow: $776m (-11.9%)

Operating Margin: 15.6% (+50bps)

Dividend: $1.45 (+25%)

Notes: Seemingly a bad quarter for TFII, the stock continues to grow due mostly to its industry reputation and the long-term thesis and growth opportunity. Despite the period of weaker environment, nothing about my thesis in TFII has changed.

Palantir - PLTR 0.00%↑

+49.1% since Q4 and FY Earnings

FY23:

Revenue: $2.23bn (+17%)

Commercial Revs: $457m (+20%)

Govt Revs: $1.2bn (+14%)

Net Income: $210m (9% Margin & up from -$374m)

Adj. FCF: $731m (+33% margin)

SBC: $476m (-15.7%)

Notes: Palantir continues to kill it, particularly with its AIP and commercial success. Improving business fundamentals combine with strong double-digit growth and reduced SBC to alleviate a lot of concerns around the stock.

What’s New at Hourglass

Podcasts

Unity Software - No Longer in Unity with My Portfolio

M-Tron Industries - Riding All the Tailwinds

Deep Dives

Payfare

Introduction The gig economy has become increasingly prevalent over the last number of years as gig platforms center their business models around underutilized assets in the economy. Think Uber, which utilizes its employees cars as assets without having to directly provide a massive fleet that would be costly to build out and maintain.

That’s all for the February recap! See you back next week for a return to normal weekly Journal issues. Happy investing folks!