Need some fresh ideas as we enter spring/summer?

We have you covered. Myself and a group of fantastic authors, investors, and friends I’ve made through my time writing Hourglass have gotten together to each analyze a company.

Everyone of us has covered a different company, idea, or current holding, varying from small- to large-cap companies and growth-focused to stable, dividend paying cos. Hopefully, the variety means there’s a little of something for everyone here! Let’s introduce the contributors and get right into it:

Cedar Grove Capital Management/

/

Investing for Beginners

And me! ()

Domino’s Pizza DPZ 0.00%↑

By

Paul is the author of and the publications, and can also be found on X @paulcerro or on his fund’s X account @cedargrovecm.

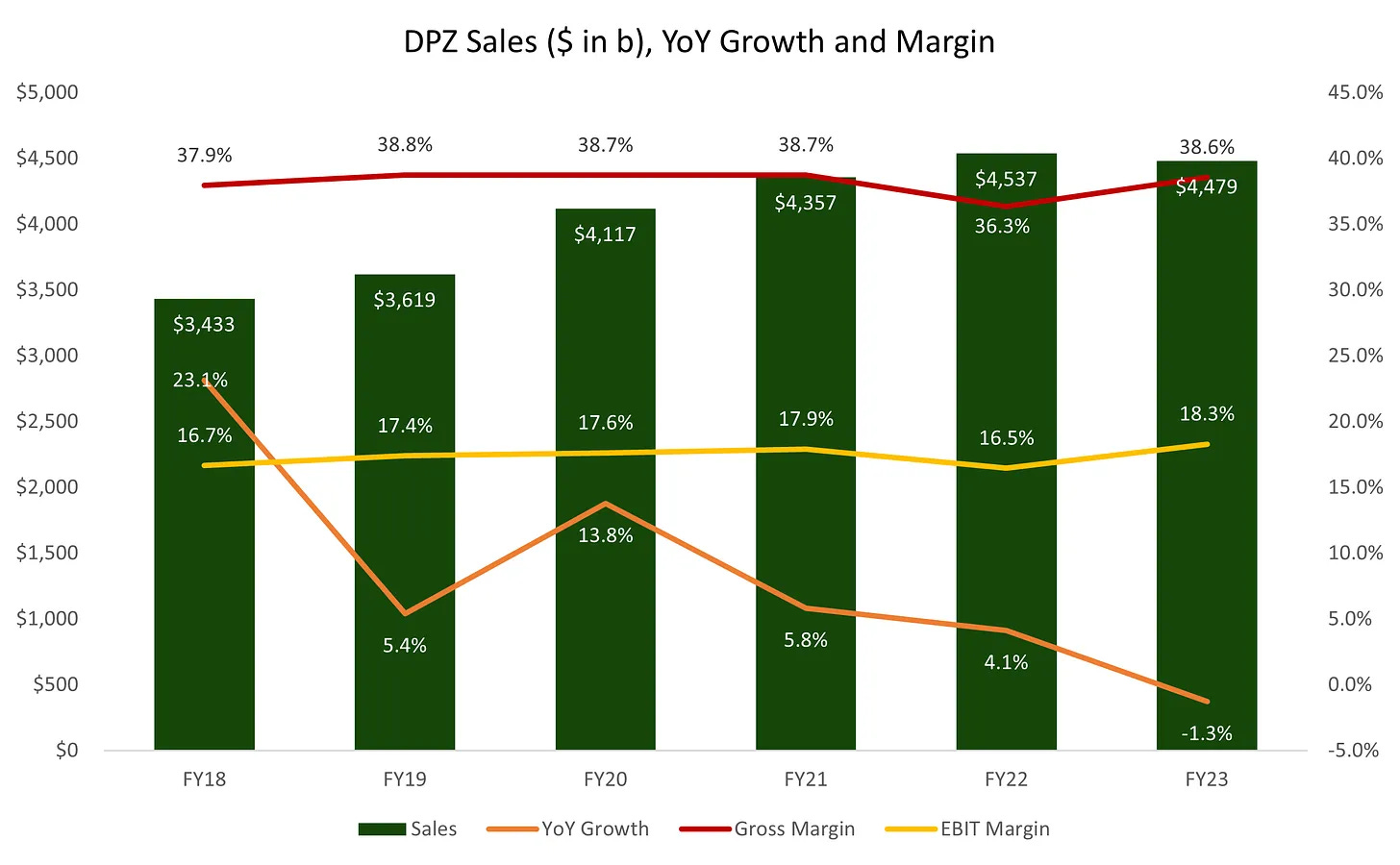

Domino’s has done well over the last few years navigating many headwinds such as food inflation, labor costs, government stimulus checks lapsing, and getting customers interested again in their pizza.

While sales hadn’t necessarily surpassed FY’22 figures, gross margins and operating margins both bounced back to pre-inflationary levels and management has guided for modest 1-3% increases in food basket costs going forward. A far cry from the 12% in 2022.

To help with labor shortages for both in-store and delivery, the company pushed heavily into carryout, expanding that business from 43% of total transactions and ~33% of total sales in 2021 to 52% of total transactions and 42% of total sales by the end of 2023.

Their stock is up ~42% in the last six months and I think this ship has fully run its course, at least in the short term, and the risk/reward from here on out isn’t worth it.

After bouncing margins back up to pre-inflationary levels, much of the future growth is coming from new unit builds, specifically international.

Fast forward to now based on the company’s newly titled “Long-Term Guidance” ranging from 2024 - 2028 powered by the M.O.R.E Hungry plan, DPZ is targeting

7%+ annual global retail sales growth

1,100+ annual global net store growth

8%+ annual income from operations growth

Here’s the issue. With targeting 7% annual global sales growth, you need to estimate significant acceleration in unit growth both domestically and internationally while also making sure to power demand and price increases.

It doesn’t take a rocket scientist to understand that much of the future growth of DPZ is heavily reliant on the ability to expand internationally. With ~6,850 stores in the U.S., management’s LT market has always been 8,000 - 8,500 stores. To combat the “saturation” problem, “fortressing” was introduced years ago to allow current franchisees the ability to overlap territories to boost overall sales and EBITDA while the underlying units would take a modest hit.

This makes sense and has been relatively successful. Based on the 2023 investor day, management is targeting 7,700+ stores by the end of 2028 which means at the current number of U.S. stores, they just need to open ~900 more in 5 years to reach that minimum target.

Based on the above, they had 3 straight years of being able to open >900 net new units in the U.S. This unit growth target I’m not worried about, and to add to that optimism.

My actual issue is that the net expansion of international stores continues to be the real driver of growth well into the future though I’m not sure how easily obtainable it is.

Looking at international net store opening targets, management has set the expectation to hit >18,500 units by the end of 2028 and >40,000 units long-term. Now I don’t have any doubt that the international whitespace is 40,000 units but opening up just under 5,000 stores in 5 years might be hard to achieve (current is ~13,700).

Looking back to 2019 (above), on a rolling basis, the company hasn’t been able to open up even more than 4,000 stores in that same time frame.

All this isn’t meant to diminish the progress the company has made over the last two years from what was a pretty crap situation to navigate. However, based on my model, I can’t see a path where the upside here is a slam dunk as opposed to other opportunities currently out in the market.

Based on the above, I think I’ve been pretty generous and still don’t see the crazy upside.

Click through to my newsletter post here so you can see the rest of my research and the numbers behind the model you see above. While I’m not saying DPZ is a short or not worth going long, I am saying that on a risk-adjusted basis, there are far better opportunities out there at the moment.

Kitwave Group Plc

By

Jon is the founder/writer of the newsletter and . He can also be found on X @equitybaron.

Kitwave is listed on London’s AIM stock exchange with the ticker KTW and has a current market cap of £254 million.

What I like about Kitwave is the business is reliable, predictable, and provides an essential service for its customers.

Founded in 1987 Kitwave is a wholesale business delivering impulse products, frozen, chilled and fresh foods, alcohol, groceries and tobacco to approximately 42,000, mainly independent, customers across the UK.

This diverse customer base includes independent convenience retailers, leisure outlets, vending machine operators, foodservice providers and other wholesalers, as well as leading national retailers. They have 32 depots around the UK ensuring speedy delivery across the island.

While operating margins for a business like this are low, around 4%, the growth has been excellent. Last year alone revenue grew by 20% to £602.2 million (fy22: £503.1 million). Profit before tax increased by 40% to £24.9 million.

Returns on capital employed over the past eight years have averaged around 20%. The company has debt of £58 million which is manageable.

Competitive Advantages

At first Kitwave may seem like a very plain low margin distribution business but dig a little deeper and you can see some competitive advantages.

They have carved out a nice business for themselves by focusing on supplying small shops such as newsagents who get ignored by the big distributors because their order value is too small.

Kitwave has focused on serving these smaller customers with the average order value being around £400 compared to Booker (a big distribution company in the UK) whose minimum order value is £1,000. Rather than competing with the big fish on price it has niched down to focus on providing a reliable service to the overlooked shops.

Customers place their orders through the Kitwave website. The bespoke built software at the backend calculates the precise cost to serve each customer depending on their location. This ensures target profit margins are achieved.

Another key part of the business is the distribution of frozen and chilled foods. Delivering these products requires managing a more complex cold chain operation with a refrigerated fleet. The extra investment needed to compete in this area creates a barrier to entry for many firms.

In fact some of the UK's largest wholesalers such as Booker and Bestway actually outsource their frozen delivery to Kitwave. A national contract was recently secured to supply ice cream to all Domino's Pizza UK outlets, after being recommended to Domino's by Ben & Jerry's manufacturer Unilever. Winning contracts from recommendations and word of mouth is testament to the quality of their operation.

Growth Opportunities

Growth so far has been achieved both organically and through acquisitions. Kitwave have done an excellent job of making bolt on acquisitions. The strategy is to acquire smaller complementary businesses, which are predominantly family-owned.

Management believe Kitwave is well placed to capture market share in the highly fragmented UK grocery and foodservice market. Currently KTW only has 2% market share, so there is plenty of room to grow. There is also room to expand internationally.

Management

Founder Paul Young, who retired last month, owns 15% of the company. There is always a risk when someone so integral to the operation leaves. However, he has been replaced by COO Ben Maxted who has been in his role since 2011 and is more than capable of running the show.

Valuation

KTW trades on a current PE of 12, which seems about the right valuation for a business of this nature. The dividend yield is currently 3.2% and has been increasing every year. There has been little dilution to the share count.

Conclusion

I’m a big fan of boring companies with simple business models, consistent and repetitive income streams, capable management, healthy balance sheets, and growth opportunities ahead. Kitwave ticks all those boxes.

I also like businesses that can increase the value of their business in real terms. The UK has seen about 30% inflation since 2021, any business that has not increased revenue or profits by the same amount is losing value in real terms. Kitwave can handle inflationary pressures better than most by passing price rises on to its customers.

In February management stated that trading so far this year has started satisfactorily and they expect a positive outcome for the year. The construction of a new 80,000 sq. ft. distribution centre to fully integrate the group’s south-west operations has commenced with completion planned for the autumn. I hold.

Semler Scientific

By

Kevin is the author of and can be found on X @atmosinvest.

A highly profitable medical SaaS business trading at a PE of 10

Introduction

Semler Scientific is currently priced at its lowest PE (10) since it started making profits in 2018. Semler has achieved a 5-year revenue growth rate of 26% and a Free Cash Flow growth rate of 40%.

Is Mr. Market overreacting?

Let’s dig in.

Semler Scientific (Ticker: SMLR) develops and sells the QuantaFlo device to health insurance companies like the UnitedHealth Group (Ticker: UNH).

Quantaflo provides an easier way to detect PAD (Peripheral Arterial Disease) in an early stage (before more severe symptoms start to show).

Peripheral Arterial Disease (PAD) occurs when cholesterol and other fats circulating in the blood collect inside the walls of the arteries that supply blood to the limbs. This buildup narrows arteries and can lead to reduced or blocked blood flow (atherosclerosis).

Detecting an increased risk of developing PAD is of interest to insurance companies (and patients) to avoid future higher costs before heart disease and more severe complications arise in patients.

The incentives for insurance companies to use Quantaflo are based on better risk assessment and reimbursement from Medicare (US Federal Health Coverage Program) which lists the early detection method of PAD in their advantage program.

In February 2023, the CMS (Center for Medicare and Medicaid Services) proposed the removal of PAD without complications from the Medicare Advantage risk adjustment model. Only when Quantaflo is used on patients who already exhibit certain symptoms with PAD will the testing be reimbursed.

The decision could lead to less testing and use of the Quantaflo system. This news and the latest Q1 earnings call resulted in the stock trading at its lowest P/E (10) or FCF yield (11%) since it started making profits.

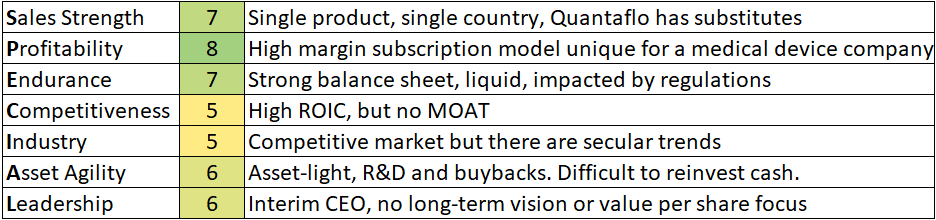

We’ll assess the quality of the company using our SPECIAL ranking system. Then we’ll look at what kind of future growth the market price is implying to judge if Mr. Market is overreacting or not.

How SPECIAL is Semler Scientific?

The quality of the company will be determined by how SPECIAL the company is. We define it through 7 attributes. Each attribute has a 10-question checklist behind it.

S for Sales Strength

P for Profitability

E for Endurance

C for Competitiveness

I for Industry

A for Asset Agility

L for Leadership

Sales Strength

Semler sells the Quantaflo at cost in the United States. Revenue is generated by a monthly subscription or by a fee per test per patient. The business model is more akin to a software company than a medical device company.

The Quantaflo provides an easier and cost-effective way to test for PAD compared to the more traditional Ankle Brachial Index testing which requires a specialist technician.

Revenue has been organically increasing over the last few years, but Q4 of 2023 showed a more modest increase in revenues of only 9%. (vs. 20+% in the other quarters)

The weaknesses in sales strength are:

Signs of weakness in Q4 sales

“One trick pony”: 1 single product

Sales are only in the United States

Concentration risk: 3 main insurance companies provide 80% of revenue

Verdict: 7/10

Profitability

They have had very high gross margins of 93% in the past, but these have dropped to 77% in Q4 of 2023.

Profits have been steadily increasing since 2018. EBIT margins are high but again have plummeted in Q4 of 2023:

This can be directly attributed to a decline in growth in revenue and an increase in OPEX costs for the last quarter of 2023.

Despite this increase, Semler has reduced its headcount from 127 FTE at the end of 2022 to 92 FTE in 2023.

Finally, Semler has very high-quality earnings with a Free Cash Flow to Net Income ratio of almost 100%

Verdict: 8/10

Endurance

Our Endurance checklist looks at the strength of the balance sheet and how resilient the business is. Can it withstand regulatory changes or downtrends in the economy? How long can the company endure?

Semler has a fortress balance sheet. It has no debt. Their cash position has been increasing yearly to about 57 million USD which is 30% of their current market cap.

Semler is liquid, with current assets being 10 times current liabilities.

Despite their strong balance sheet, the business is dependent on certain regulations, proven by the change in Medicare coverage which will impact their business going forward.

The business can be seen as defensive (there is a need for testing chronic diseases) but future innovations in testing methods might be disruptive.

Verdict: 7/10

Competitiveness

Every business with a MOAT has a great ROIC. But every business with a high ROIC doesn’t necessarily have a MOAT.

Data source: Gurufocus.com

Semler manages to generate great returns with very little invested capital.

Their main competitive advantage is the relationships they have built with the different insurance companies. A startup can build a new innovative medical device, but selling it to an insurance company is a lot harder.

The patent for Quantaflo will expire on the 11th of December 2027.

There are substitutes for Quantaflo. We couldn’t find signals of pricing power. The change in regulations will provide a first glimpse if they are forced to lower prices to keep sales incoming.

We conclude that Semler at this time, does not have a durable competitive advantage (MOAT).

Verdict: 5/10 (to compare, Visa gets a 9/10)

Industry

The medical device industry is a very competitive market. There are few barriers to entry.

Out of the 808 public companies, most are unprofitable or barely profitable. Semler sits within the elite best 10% with net margins exceeding 23%. (data: gurufocus.com)

Semler sees a market opportunity of 80 million people in the US that could be tested:

Source: Semler company presentation

There is a secular trend as the number of people older than 65 will continue to increase according to census.gov.

The diagnostic testing market is set to increase at a 3% CAGR from 210 Billion USD to 284 Billion USD in 2033.

Despite the market growing, competition and lack of barriers to entry decrease the attractiveness of the industry.

Verdict: 5/10

Asset Agility

Semler is asset-light. The bulk of their investments for growth goes towards R&D at about 8% of revenue each year. Part of their cash is used to buy back stock from 8.14 million shares in 2022 up until 7.82 million shares at the end of 2023.

The company has made several acquisitions from 2020 to 2022: It has a minority investment in Mellitus, SYNAPS Dx, as well as Monarch Medical Technologies LLC, a privately held company whose product EndoTool® offers a technological solution for inpatient glycemic management.

However, these have not contributed to their sales in a meaningful way with a proposed write-off of the investment in Mellitus Health as additional marketing efforts have not resulted in the expected returns.

The company is looking for future opportunities to grow through acquisitions, but it is difficult to reinvest its cash at a high rate. Past acquisitions have failed to strengthen the core business.

Verdict: 6/10

Leadership

About 21% of the company is insider-owned where the founder’s son, Eric Semler, still holds 8% of the company and was appointed chairman of the board in 2023. At 28 USD he bought 2.1M USD worth of shares in September of last year. SMLR is a favorite with institutions as they own 51% of the company.

The management team has a salary which is below the average of comparable companies:

Source: Semler 2023 annual report

On the 1st of April, the CEO resigned and received severance compensation. On the 27th of April, he was reassigned to the post of interim CEO.

The company is looking for a permanent CEO and provides stock-based compensation on revenue of about 1.4%.

I couldn’t find any data points that support the CEO or management’s focus to optimize long-term value per share.

There aren’t any signs of a long-term vision for the company. It’s not clear where the company wants to be over 10 years and how to get there.

Verdict: 6/10

Valuation

What is the current market price implying? Let’s look at different scenarios.

In 2023, Semler generated a free cash flow of 19 Million USD. If we assume:

A 10-year DCF

A 10% discount rate

A 2% perpetuity growth rate

Then for different starting Free Cash Flow levels and 10-year growth rates, the following reverse DCF provides these scenarios:

133% means a starting FCF of 9 Million (2019 value) and no growth, the company is priced too high in the market by 33% compared to the current enterprise value

34% means a starting FCF of 19 Million (2023 value) and a 10% FCF growth rate over the next 10 years, the stock is undervalued

The market is pricing in a decline of the company. It expects a slowdown in revenue growth rate combined with more investments needed to grow. This leads to a drop in free cash flow.

The negative news and risks surrounding Semler seem to be priced in at this time.

Conclusion

Semler has shown great performance in sales and profitability in the past and they have a unique Saas business model in the medical devices industry.

Their strong balance sheet should buy them some time for the future now that slower sales growth might be on the horizon.

Semler has several vulnerabilities:

They only sell a single service

There is some customer concentration

They are dependent on regulations like Medicare with the recent changes

They have been unsuccessful in allocating capital to fuel future growth by developing new services or through acquisitions

Management seeks to respond to these vulnerabilities by:

Looking for acquisitions

Appointing a new permanent CEO

Unlocking more use cases for Quantaflo by expanding FDA approval to more cardiovascular risks (they expect approval in the second half of 2024)

Semler has referenced several studies to show that they believe the recent decision on the changes in Medicare was wrong, but it seems unlikely the CMS will revert its decision.

The slowdown and risks are priced into the stock at this time and could provide an opportunity

if the Medicare changes have a more moderate impact than the market is expecting

if Semler finds a way to grow their Quantaflo user base (pending FDA approval)

if Semler finds the right target for acquisition and expands their product base

The earnings call on the 7th of May should be interesting.

I hope you enjoyed this first look into Semler.

As always, may the markets be with you!

Kevin

Nubank

By

Author of and writes on X @LDiscernment.

Overview

Nubank is one of the worlds largest digital banks and fin-tech platforms, boasting an impressive and rapidly growing customer base of almost 100 million, including 53% of the adult population of Brazil and a growing number of customers in Mexico and Columbia.

They offer credit cards, personal loans, digital bank accounts, life insurance, investment solutions and business accounts on an easy to use app.

They currently operate in Brazil, Mexico, and Columbia but in a recent interview CEO David Velez stated that they plan to become a global digital bank after becoming the largest financial services institution in LATAM.

How and why they’re winning

How

Taking a page out of the Innovators Dilemma— Nubank disrupted Brazilian incumbents from below, targeting customers who were underserved by traditional banks, then slowly moving market after establishing themselves.

The highly concentrated banking sector in Brazil created the necessary pre-conditions for disruption as traditional banks had no competition and little incentive to innovate or serve customers. The result was a largely unbanked population, high fees, high interest rates and unsatisfied customers.

It’s no surprise that Brazilians were ecstatic when Nubank launched the first no annual fee credit card that could be opened with the click of a button. Then they successfully launched a handful of other financial products and began repeating this processes in Mexico and Columbia with similar viral results.

Their viral success is kind of mind boggling. Within a decade over 50% of the adult population of Brazil—and a growing number of Columbians and Mexicans— became loyal Nubank customers largely through word of mouth (80% -90%). To further underline the virility of their products, just one month after launching their savings account in Mexico they reached 1 million accounts.

As customer engagement has continued to grow, over 50% of customers are using Nubank as their primary account within the first year of signing up. The number of products per customer has hit an average of 4, of which 2-3 are adopted in the first year.

Why

Nubanks is able to offer lower cost products to customers because they benefit from a cloud based model that affords them the ability to pass savings on to customers and ultimately shareholders. Over the last few years the company has maintained an average fixed cost to serve each customer of about $1 per month while growing their average revenue per active customer (ARPAC) from $3 to $10 per month, showcasing their operating leverage as they swung to profitability in 2023.

Their branchless model has afforded them an industry leading efficiency ratio around 35-36% which means out of each dollar in revenue they only spend around $0.36 in back office expenses. This is exceptional considering two of Nubanks biggest and most efficient competitors, Itau and Banco Santander, spend about $0.40 and $0.44.

They also benefit from a very low customer acquisition cost (CAC) because almost all of their customers (80% - 90% ) have come by word of mouth. In my conservative estimation, Nubank’s lifetime value (LTV) for each customer is about $185, and when compared to their customer acquisition cost (CAC) of $7, this implies a lifetime value that is almost 27x greater than the cost to acquire each customer.

Nubanks opportunity going forward

The unbanked and new markets

According to the world bank, as of 2021, there were approximately 100-120 million unbanked people in Latin America, this doesn’t include Mexico which has another 70-80 million for a total of around 170 million in 2021-2022. This could provide Nubank with a large opportunity to serve those who aren’t currently being served by traditional banks.

Also, like I previously said, David Velez alluded to eventually launching in other regions outside of Latin America which could prove to be a huge opportunity.

Moving up market and further penetration

Nubank initially targeted low end customers (less affluent / unbanked) and since establishing credibility, they’ve begun to move up market—targeting middle and upper class. They launched NU Ultravioleta, a credit card for the affluent and it wouldn’t surprise me if they continue on this path.

Taking market share

The existing profit pool in Latin America is substantial and presents a big opportunity for Nubank. To put it into perspective, just the top 10 biggest banks represent about USD $40-50 billion in earnings, and they do this while providing an underwhelming experience for their customers. Nubank is aiming to continue taking share by providing a superior user experience and customer service at a lower cost.

Risks

Credit risk: A good portion of their lending is geared towards middle and lower class customers which obviously creates a higher risk for non performing loans.

Note: Nubank doesn’t just hand out credit cards to anyone, most customers are first offered a bank account or other financial product. Once Nubank see’s consistent cash flow or signs of creditworthiness, they may extend credit. Also, as I said earlier, they’re attempting to move up market to more affluent customers. Regardless, as it sits right now, they’re still exposed to a more risky cohort and this remains a concern for me.

Brand: They have a very strong brand and that has helped them to draw in a large amount of customers with a very small customer acquisition cost. If for some reason their brand was impaired, it could spell big trouble for them.

Regulatory: Brazil has unusually high interest rates and a favorable banking environment. Regulators have been taking a tougher stance towards banks. This poses some regulatory risk.

Management

Nubank was founded by David Velez, a former partner as sequoia Capital. Velez owns 21% of the company and runs the company like an owner should, balancing company growth with a focus on shareholder value and efficiency. Also, large portion of employees (75%) are either owners of shares or hold share based incentive awards.

Conclusion

Nubank is an amazing company with big ambitions. It’s also not extraordinarily expensive. Most analysts say they will be earning $0.41 per share by the end of the year. In my estimation, the company could grow revenue between 35-50% this year and earn $0.37- $0.39 per share, which implies its trading at around 29 times 2024 earnings.

Brown & Brown

By Investing for Beginners

Investing for Beginners is the host of the Investing for Beginners Podcast and owner of the IFB website. They can also be found on X @IFB_podcast.

“Insurance policies… are the most complex contract that you’ll ever enter into without the help of a lawyer.”

Brown & Brown (BRO) is the sixth largest insurance broker based on 2022 revenues.

It primarily operates in the U.S., with less than 7% of revenues from international markets. Its insurance offerings span property and casualty, employee benefits, personal insurance, and specialized flood insurance products.

Brown & Brown operates under a decentralized model, remains family-run after 84 years, and primarily competes in the middle market.

These aspects distinguish it from competitors, maintaining local branding for acquired firms and encouraging employee stock ownership.

The insurance brokerage industry, particularly for businesses like Brown & Brown, plays a critical consultative role due to businesses’ complex and customized insurance needs. This importance, along with high recurring revenue, low capital expenditure, strong EBITDA margins, and high barriers to entry, underscores the industry’s resilience and value, even in economic downturns.

Brown & Brown stands out for its high insider ownership, approximately 35%, largely by the Brown family, and significant employee ownership.

The company has cultivated a strong corporate culture emphasizing employee stock ownership at a discount, fostering loyalty and wealth accumulation for its employees, which is a key factor in its success.

The insurance brokerage industry has consolidated significantly, with Brown & Brown emerging as a top-five broker (US) by revenue, highlighting its growth potential.

Despite its current size, Brown & Brown has ample room for expansion compared to industry giants like Marsh and Aon, partly due to its strategy of making numerous smaller acquisitions.

How They Make Money:

Brown & Brown generates revenue primarily through commissions and fees for selling insurance products.

As an intermediary, Brown & Brown connects insurance carriers with customers without taking on underwriting risks. They earn commissions, typically 10% to 15% of the premiums. Due to their complexity, commercial lines yield higher commissions than personal lines. Fluctuations in exposure units and premium rates drive growth.

In the world of insurance brokers, the key revenue drivers boil down to a couple of critical elements: the fluctuation in exposure unit (which you can think of as the total dollar value covered) and shifts in premium rates (which are just a fancy way of saying price changes).

When we talk about exposure units, we’re referring to the number of customers, how many items each customer insures, and any changes in the value of those items.

For a company like Brown & Brown, they’ve shared that price changes account for about one-third to one-quarter of their growth.

The rest?

Changes in exposure units drive that. Besides premiums, brokers make money through fees for additional services, like managing third-party claims. This part of their business is crucial but often not highlighted enough.

Pricing in the insurance brokerage world is much like a seesaw, always shifting based on the balance—or imbalance—between supply and demand for insurance coverage.

Let’s take a natural disaster as a prime example. Say a hurricane or flood just rolled through.

The aftermath?

Insurers would face hefty payouts, especially if they weren’t too strict with their underwriting standards. As a result, some carriers might decide to stop covering such risks in the future, leading to a tighter supply of insurance.

This mismatch between eager buyers and scarce coverage is what’s known as a hard market.

Insurance brokers often find themselves in a sweet spot during these hard market phases.

Why?

Because their commissions are typically tied to the premiums’ value. When prices soar, so do their earnings through increased organic revenue growth. This is a clear example of how market dynamics can influence financial flows within the insurance sector, showing just how interconnected things are.

The insurance brokerage industry has seen considerable consolidation, and Brown & Brown actively participates in acquisitions. Acquisitions are a big part of their strategy.

Brown & Brown’s acquisition strategy focuses on cultural fit and operational alignment, with significant capital allocated towards acquiring brokerage businesses that complement or expand their existing services and market reach.

This strategy is sustainable due to organic revenue growth in both normal and hard markets and numerous private equity firms active in this space.

Brown & Brown currently generates around mid-single-digit organic growth throughout the P&C insurance pricing cycle.

The company operates through four segments:

Retail – Direct sales of insurance products to businesses and individuals (58% of total revenues).

National Programs – Specialized insurance programs and products for professional, business, and trade associations (25% of total revenues).

Wholesale Brokerage – Distribution of insurance products to other brokers, acting as an intermediary (13% of total revenues).

Services – Provides insurance-related services, such as third-party claims administration and comprehensive medical utilization management (4% of total revenues).

What Their Product Solves:

Brown & Brown offers risk management solutions that protect clients against financial losses due to accidents, natural disasters, lawsuits, and other liabilities.

Their services help businesses and individuals navigate the complexities of insurance coverage, ensuring they are adequately protected while potentially saving on premiums.

Their specialized programs for various industries address unique risks, providing tailored solutions that generic insurance packages might not cover.

Main Costs:

Employee Compensation and Benefits – As a service-oriented company, a significant portion of expenses goes toward salaries, bonuses, and employee benefits.

Operating Expenses – This includes costs related to office maintenance, technology infrastructure to support its brokerage and services operations, and marketing.

Acquisition Costs – Brown & Brown actively acquires smaller firms to expand its market presence and service offerings, incurring related expenses.

Customers:

Brown & Brown serves a wide range of customers, including:

Small to large businesses across various industries seeking commercial insurance

Individuals needing personal insurance products like home, auto, and life insurance

Professional and trade associations looking for group insurance programs

Government entities requiring specialized risk management solutions

Competitive Advantage:

Established insurance brokers, including Brown & Brown, enjoy substantial competitive advantages such as brand recognition, long-term client relationships, and contractual barriers like non-compete clauses.

These factors contribute to high barriers to entry for new competitors and safeguard the incumbents’ market share and profitability.

Legal documents and government intervention in proposed mergers, like that between Aon and Willis Towers, reveal the competitive strengths and regulatory recognition of the insurance brokerage industry’s complexities. These dynamics further affirm the strategic positioning and growth potential of companies like Brown & Brown within this lucrative and protected sector.

The company has demonstrated favorable returns on incremental capital, ranging from 12% to 22% annually over the past five years, facilitated by strong organic growth and strategic acquisitions.

Competitors:

Major competitors include other insurance brokers and risk management service providers like:

Marsh & McLennan (MMC)

Willis Towers Watson (WTW)

Aon plc (AON)

Gallagher (AJG)

These firms compete in service offerings, customer experience, market reach, and technological innovations.

Positive Points:

Diverse Revenue Streams – Operations across different segments reduce dependence on any single market.

Strong Acquisition Strategy – Continual expansion through strategic acquisitions has broadened its market presence and service capabilities.

Specialized Programs – Tailored insurance solutions for specific industries and associations create competitive advantages.

Solid Financial Performance – Strong financial results demonstrate operational efficiency and effective growth strategies.

Experienced Management Team – Leadership with deep industry knowledge and strategic vision guides long-term growth.

Lack of underwriting risk – Because of their business model, they don’t carry the same level of underwriting risk as other providers, such as Allstate.

Negative Points:

Regulatory Risks – The insurance industry faces strict regulations affecting profitability and operational flexibility.

Market Competition – Intense competition from large global firms and niche local providers pressures margins.

Economic Sensitivity – Economic downturns can reduce demand for insurance products, impacting revenue.

Valuation:

We can determine its fair value Using various methods to value Brown & Brown.

Using the TTM P/E Ratio, we can see that it is a fair value compared to others in the industry.

BRO = 26.53

MMC = 26.07

AON = 24.3

WTW = 25.8

AJG = 52.36

Using a DCF, my favorite method, with the following inputs, we get:

Revenue growth = 8.5%

Operating margins = 28%

ROIC = 13.7%

WACC (discount rate) = 7.13%

Sales to Capital Ratio = 0.58

After applying all the inputs, we get a value of $119.01, compared to the current market price of $81 (April 17, 2024), giving us a safety margin of 46%.

Risks:

No matter how great any company is, they will have risks. Here are some Brown & Brown faces:

Economic Downturns – Lower economic activity can reduce insurance spending by businesses and individuals.

Regulatory Changes – New regulations or changes in existing ones could increase operational costs or limit business practices.

Cybersecurity Threats – Any data breach or cyber-attack could have severe reputational and financial consequences in an information-heavy industry.

In conclusion, Brown & Brown, Inc. is a well-established player in the insurance brokerage and risk management industry, with diversified operations helping to mitigate market-specific risks.

One reason for my enthusiasm for the company is that while it is growing, there remains quite a large opportunity in the insurance market. Experts estimate BRO has a $90 billion opportunity, and with only $4 billion+ in 2023 and 5% of the market, it has a long runway.

Its growth strategy, focusing on acquisitions and specialized service offerings, positions it well for future expansion.

However, regulatory, economic, and competitive challenges highlight the importance of strategic agility and innovation in maintaining its market position.

Full disclosure: I am long BRO

RediShred Capital Corp

By

Dean is the author of and writes on X @petty__cash.

*Disclosure: I own shares in XX. I am not a professional. Please do your own due diligence.

TL:DR

KUT (RediShred Capital Corp) is in what is perceived as a declining industry. The business is far from sexy, but it’s consistent and durable. The company is currently trading at their lowest valuation in the last 5 years. Additionally, they are exposed to recycled paper prices and are lapping easier comps starting Q2 2024. Management is solid and there are not a ton of shares outstanding. All of their warts can be easily removed, which should propel the shares in 2024 and beyond.

KUT reported on Monday and held a call Tuesday morning. There was nothing concerning about the call. I felt the tone was positive.

I have held KUT for a couple of years and am below water, so it may be best to skip this article. lol

1 yr performance: -30%

Price: $2.73 CAD

Shares: 18.3 million (fully diluted)

Market Cap: 50 million CAD

Enterprise Value: 82 million CAD

Background

KUT operates the ProShred franchise and license business in the United States. The company was incorporated in 2006 and is headquartered in Mississauga, Canada. Primary services provided by KUT include, shredding and destruction services; offers electronic waste disposal services under the Secure e-Cycle brand name; sells recycled paper and other recyclable by-products, such as metals and plastics; and resells electronics. In addition, it offers digital imaging, scanning, and related workflow management services. How do they add value

So far this probably seems pretty boring and, in all honesty, KUT is not a company that will impress anyone on your pickleball team (if pickleball has teams) or at the company bbq.

Despite what KUT looks like on the surface, they offer more than just paper shredding to customers.

They offer on site shredding vs. others in the industry offering off site shredding. This can be a scheduled or unscheduled (one-time) service. When the client chooses the on-site option, the customer will receive a certificate indicating their documents have been destroyed at the end of the service. The shredded paper is then bundled and the paper is recycled and sold. Revenue derived from paper recycling is subject to commodity paper prices.

They also offer e-waste recycling services, where they dispose of various electronic devices. The components are wiped clean and some are even remarketed and sold.

Under the ProScan brand, they offer scanning services for physical documents. This service helps companies looking to digitize their documents.

Lastly, they get a small amount each quarter in franchise fees from the remaining ProShred franchises.

The majority of their revenue comes from on site shredding services, followed by Recycling (paper sales). The E-waste and Scanning portion of the business is starting from a small base but has grown nicely over the last few years.

Growth Strategy

KUT has a 3 pronged growth strategy:

Expand the location footprint in the U.S. by way of franchising and accretive acquisitions.

The acquisitions tend to have a large earn out as part of the total cost. This limits upfront capital required.

Maximize same location revenue (in particular, recurring scheduled services) and earnings for franchisees and corporate locations.

Drive depth of service and earnings in existing locations by acquiring smaller “tuck-in” acquisitions that are accretive.

The acquisitions come from two sources, existing franchisees looking for an exit and independent operators in the industry.

Existing franchisees are lower risk due to them having more modern equipment, lower integration risk, similar EBITDA margins to existing locations and largely recurring/scheduled revenue. Multiples are based on EBITDA 5-7x and usually carry about 2 million in revenue. These locations will come with their own trucks as well. KUT will use these to expand their geographical footprint and enter new markets. They have 14 franchisees left.

Independent operators are less consistent. Multiples are usually asset based as the operators may not be profitable and have the same sophistication in their operations. They may be in distress and come with a much lower revenue base (100k-1mil). These acquisitions can be quite accretive as KUT can leverage existing routes to increase density and sell additional services to the customer base. There are over 700 potential independents that would be targets.

Share Structure & Ownership

There are 18.3 million shares outstanding on a diluted basis. The CEO (Jeff Hasham) owns over 350k shares or about 2%. The board owns 16%. DKAM owns 14% and Bunky Holdings owns another 14%.

Bunky Holdings (Moray Tawse) has been a large shareholder as far back as 2015. Moray Tawse is CEO of First National Financial. First National is a non-bank mortgage lender with a market capitalization of over 2 billion CAD.

DKAM has been a holder for several years and mentions KUT regularly in their newsletter.

Management & Compensation

Jeff Hasham has been in the business a long time. He was CFO when KUT went public and was promoted to CEO in 2011.

About 50% of his compensation is salary with the balance being a mix of long term and short term incentives. The value of his holding in the common is about 1.3x his total comp in 2022. The SVPs and CFO have similar compensation packages in regard to a mix of salary, short term and long term incentives via stock options.

The company does a good job of explaining the compensation in my opinion. It’s worth checking out. Here is a screenshot from the MIC in April 2023.

Board

There are 8 directors currently, with 6 being classified as independent. That is high in my opinion given the size of KUT. The former CEO is the chair. The independent board members own about 15% of the common, which is quite high for a Canadian microcap.

Director compensation is a mix of cash and stock options. Most of it cash and not egregious. The highest comes in at $70k (for the chair) and the lowest is $25k.

Balance Sheet

Given the high visibility of the business with most of the revenue being scheduled, they deploy leverage to increase ROE. The company uses EBITDA turns as the metric of choice to calibrate the appropriate level of leverage. As of writing they are sitting at about 1.9x forward EBITDA for leverage. They want to keep the maximum to around 3x. They would have close to 20 million in borrowing capacity at this time.

Income Statement & Cash Flows

As the business has scaled, margins have expanded. They have been able to keep EBITDA margins above 20% consistently since hitting their inflection point.

The business requires a fair bit of capital expenses. They typically spend 6-9% of revenue on maintenance capital expenditures. That fluctuates quarter to quarter so it’s best to look at it on a 5-6 quarter basis.

The above chart does not include swings in working capital. It should be noted that they have required a slug of additional working capital relative to revenue on the last couple of years. I believe this will reverse to some degree.

Valuation

I have the company doing a bit over 17 million in EBITDA in 2024. This is without any acquisitions and stable paper prices. This puts them at about 5.2 EV/EBITDA. I have them at about a 5.5-6x FCF moving forward.

Risks

There are risks with any investment. Here are the main ones that I identified:

Capital Allocation

This would look like them raising equity to execute the growth strategy at a poor valuation. Don’t get me wrong, I do think at some point they may raise equity again, but I would hope it would be at much better valuations than today’s price.

I hope that they don’t kill any real rally in the share price by immediately issuing shares after a 20-30% run in the share price.

Paper Prices

The business is less and less effected by paper prices as they grow scheduled revenue and ancillary services. Having said that, if prices are volatile in a short period than KUT is affected. The incremental EBITDA from SOP price at 350 (Dec 2022) to 225 (today’s price) is material. When prices correct in a short time period, then the EBITDA margin delta is not very appealing to the public markets. Especially for KUT which is largely retail held.

Inflation

The main expenses for KUT are labour and fuel. Both can have bouts of rising prices. Over time increased costs can be passed on to the customers with some creative price increases. Another hedge is the price of paper itself. Paper prices tend to move with other commodities (like fuel) and somewhat provide a natural hedge, although they don’t move in lock step.

Going Paperless

We are using less and less paper, or at least we have been. And maybe it continues. I don’t know. The current narrative is that this is a dying industry and that’s fine with me. They have grown scheduled revenue handsomely over the last 5 years and I really don’t expect that to stop. This is more of a perception issue with the stock in my opinion.

Key Management

Though I’m not sure if it would completely kill the idea, but I do think they are very reliant on the current CEO. As with most microcaps, management execution is paramount here.

Economic Stability

I think it goes without saying that if there was some sort of financial crisis and offices were laying off workers, KUT would be affected.

Auditors Notes

There are notes in the audited statements regarding going concern. I am not concerned from a cash flow standpoint, but this is something that may affect borrowing costs and access to capital to execute the M&A plan.

Closing Thoughts

KUT has a straightforward path to more than double EBITDA. They have around 10 million possible from existing franchisees with most agreements expiring in the next 3 years. They have quite a bit more opportunity with independents that are not as streamlined, though the EBITDA opportunity is mostly post integration. There is also some continued organic growth via increased same location shredding revenue, scanning and e-waste opportunities. Putting those together I feel that KUT deserves a better multiple.

The most recent quarter demonstrated that they don’t need to rely on paper prices to grow EBITDA. The base business is at a sufficient scale to grown profitably from here and an extra bump from recycling is welcome.

I think KUT fits nicely in a portfolio. It provides some diversification with little correlation to the capital markets (although it hurts when the indexes rip and KUT doesn’t). I think the current narrative has some room to shift and become more positive. The business has chugged along while the share price has stagnated leaving many investors fatigued as we watch our neighbors get rich on memecoins.

Thanks for reading.

Dean

*disclosure – long KUT.v

Toast

By

Jared is the author of , host of the Hourglass Investing Podcast (new episodes coming soon!) and can intermittently be seen on X @hourglassnetwrk.

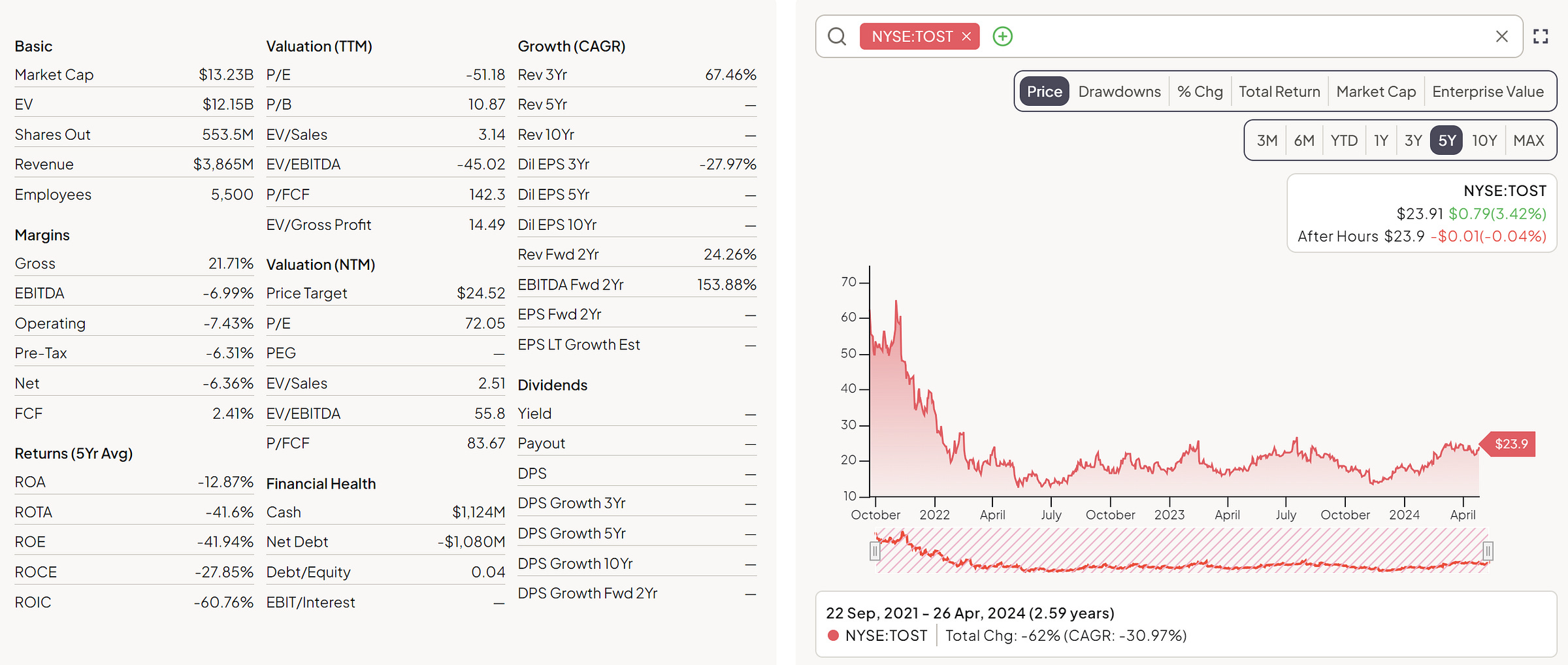

Overview - TOST 0.00%↑

Market Cap: $13.3bn

Enterprise Value: $12.3bn

Revenues: $3.87bn

Gross Margins: 21.7%

FCF: $93m

P/E: N/A

EV/S: 3.1x

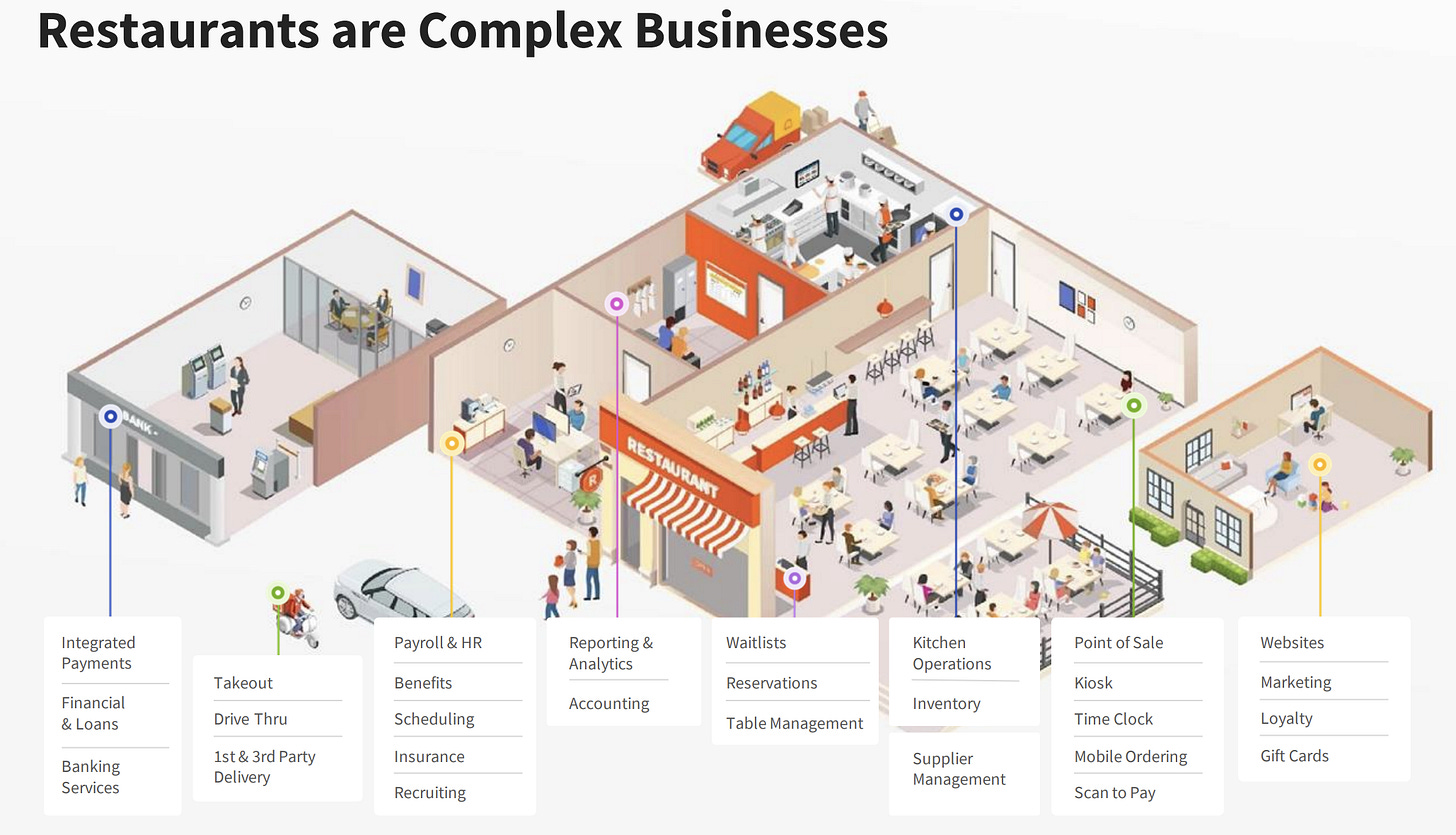

Ever sat at a restaurant and wondered how the hell they manage the chaos? Perhaps you’ve even worked in one and can speak to the chaos first-hand?

I fall into the last category. Having seen firsthand how hectic managing a restaurant is (I basically watched my manager get grey hairs in front of my very eyes) during my time working at one, I can tell you that it’s no easy job. There’s a ton to juggle.

So that’s why Toast caught my eye when I came across it; Toast is building itself into an end-to-end platform for restaurant management. Its services to restaurant owners include:

POS hardware

Accounting & payroll platforms

Team & delivery management

Access to capital

Easy creation of a digital storefront

Marketing/loyalty programs

Many small- and medium-sized restaurants, which make up the vast majority of Toast’s clients, have to find separate providers for most if not all of these different features. Combining these into a single stack helps busy owners save time and cut costs, of course, but more importantly helps to improve their operations for better guest experiences which drive higher tips and, in turn, better employee retention.

This value prop to restaurant owners is significant, and helps to explain how Toast has grown its total number of locations from 79K in Q4 ‘22 → 106K in Q4 ‘23 (34% YoY growth).

That impressive industry adoption helps to explain Toast’s YTD outperformance over the wider market, popping off for 33% growth and reaching a market cap of $13.3bn. But there may still be plenty of potential opportunity ahead for Toast; operating in a massive $55bn US total addressable market, let’s see if this company can live up to the hype and continue beating expectations.

The Fundamentals

Balance Sheet: The Good

Topline Revenue Growth: 42%

Capital Efficiency Improvement

ROIC: -66.6% → -37.4%

ROE: -66.3% → -21.4%

ROCE: -22.5% → -22.4%

SG&A Expenses as % of Revenues Declining

Ongoing R&D Investments

Free Cash Flows → Positive from Q2 ‘23 to TTM

Next to No Debt on the Balance Sheet

D/E: 0

Cash Ratio: 0.9

Current Ratio: 2.4

Minimal Shareholder Dilution (Total Shares Outstanding → 3.5% CAGR from ‘21 to ‘23)

Balance Sheet: The Bad & The Ugly

Negative Profitability

EBITDA

Net & Operating Income

Cash Not Adequate to Cover Debt

Negative Capital Efficiency Metrics

Valuation

P/S: 3.4x

P/E: N/A

EV/S: 3.1x

FCF Yield: 0.7%

EV/EBITDA: N/A

KPIs

ARR (Annual Recurring Run-Rate): $1.2bn (+35% YoY)

GPV (Gross Payment Volume): $126bn (+38%)

Locations: 106K (+34%)

NRR (Net Retention Rate): 111%

Payback Period: 14 months

The Pros

Toast’s growth across key metrics clearly demonstrates that the company is serving a need. The typically underserved small- and medium-sized restaurant client base that Toast serves has allowed them a significant foothold in the market: 106k restaurants are using Toast’s products and, even more impressively, 43% of them are using six or more of Toast’s product offerings. While growth has stagnated over the last several quarters on the percentage of customers using multiple products, it still shows that Toast’s end-to-end platform is satisfying a number of needs for customers.

Revenues are nicely differentiated across the different products, with most revenues coming from high-margin and recurring subscription & fintech services. A very small percentage of revenues comes from professional services, as well as third-party hardware, which serves as a drag on the margin profile but is a needed solution for most restaurants.

Finally, while Toast remains in the red for most bottom-line metrics, it is improving as it hits scale. EBITDA, operating, and net profit losses are narrowing significantly, free cash flows slid into the green in Q2 ‘23, and gross margins are also improving. This is a positive point for investors, particularly as they come without a significant slowdown in growth of revenues or key metrics.

The Cons

There are risks with both Toast the investment and Toast the business. From an investment perspective, this is a mid-cap company that still has a lot of the metrics of a much smaller company: negative capital efficiency metrics, exceptionally low or negative margins, and negative profitability.

This isn’t necessarily bad. Many companies have found themselves in similar predicaments as they continue funneling investment into growth and improvement of the platform, and still turned out to be successful companies. My complaint with it, however, is that you are assuming a lot of the risk associated with small-caps without the associated upside of growing from a smaller base; a 10x from its current market cap would put the company at a rich $130bn valuation - quite unrealistic for a company of this nature, in my eyes.

On the business side of things, Toast’s client base of mostly small/medium restaurants are notoriously unattractive businesses: very low margins, lots of turnover, extreme risk of failure, and high exposure to macroeconomic conditions. This consequently puts Toast at a lot of risk; if they were serving larger, higher-end restaurants or chains, I would find Toast’s business a lot more attractive. Unfortunately, this class of customer are mostly being served by in-house solutions or other providers, which limits Toast to taking on the risk associated with smaller restaurants.

My final note of risk on Toast the business is that their serviceable addressable market (SAM) is ‘only’ $15bn; with annual revenues already at $3.9bn, the growth potential into that market is limited. While the company certainly markets more towards the $55bn TAM, much of this market is the larger restaurant chains being serviced by other providers.

To continue growing past the $15bn SAM, Toast would need to focus on international expansion, something I always view with a large degree of concern (there’s usually other players and international expansion just isn’t as easy as business executives like to present in annual reports). Elsewise, growth is likely to slow and Toast’s shares would likely suffer from lower multiples as the new growth rates were factored into the business.

Final Thoughts

It’s undoubtedly an interesting company. I think Toast has a lot of upside as a business and is clearly serving a need in the market. However, I have to take the pass on it; there’s a lot of risk from both a business and investment perspective, and I’m really not attracted to the mid-cap space at all. There’s simply not enough upside to tempt me into taking the additional risk in my portfolio of a) unproven capacity for profitability, b) volatility of small/medium-sized restaurants, and c) questionable market size.